Fintech Wallet App

A secure, intuitive wallet app that supports UPI payments, lets users split expenses with friends, and gives clear visibility into personal spending.

Duration: 3 Weeks Tools: Figma, Lucid, Adobe Photoshop

A secure, intuitive wallet app that supports UPI payments, lets users split expenses with friends, and gives clear visibility into personal spending.

Duration: 3 Weeks Tools: Figma, Lucid, Adobe Photoshop

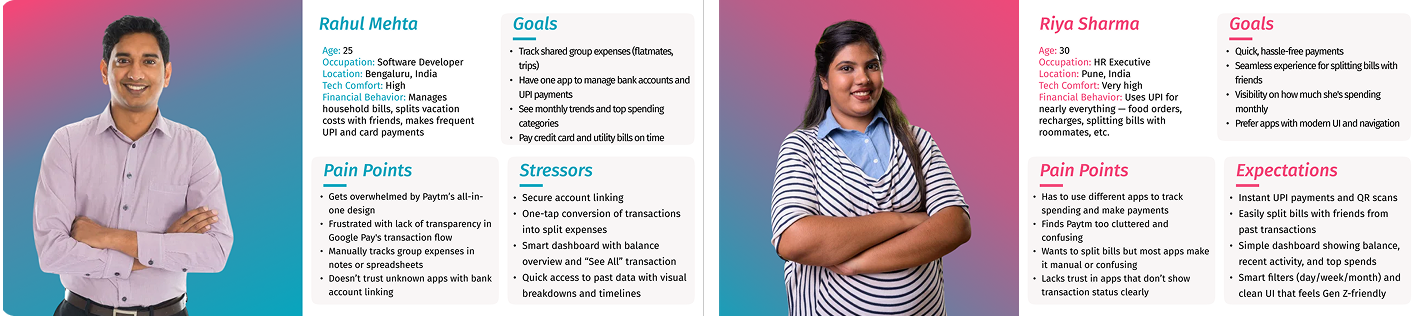

Users need a clean and secure platform to manage digital payments, track expenses, and split costs with others — all without switching between apps.

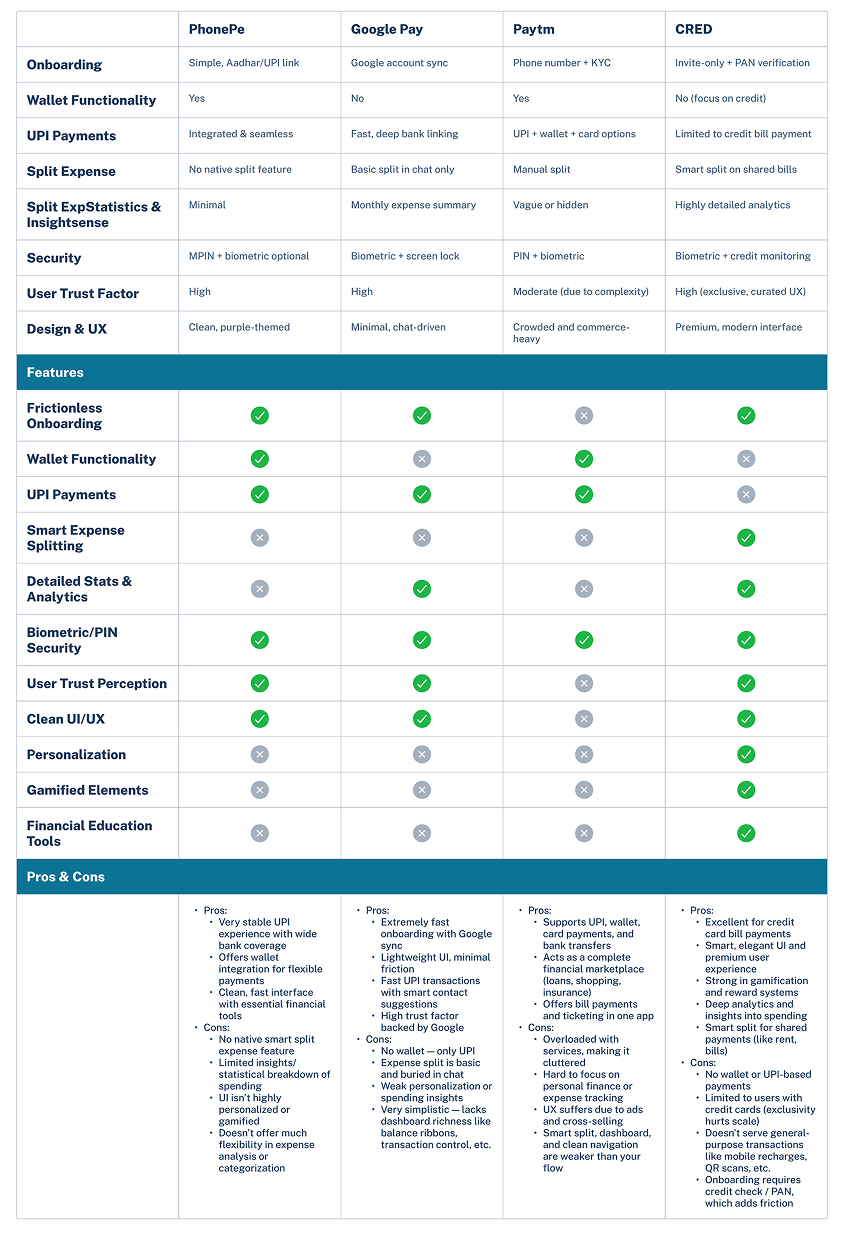

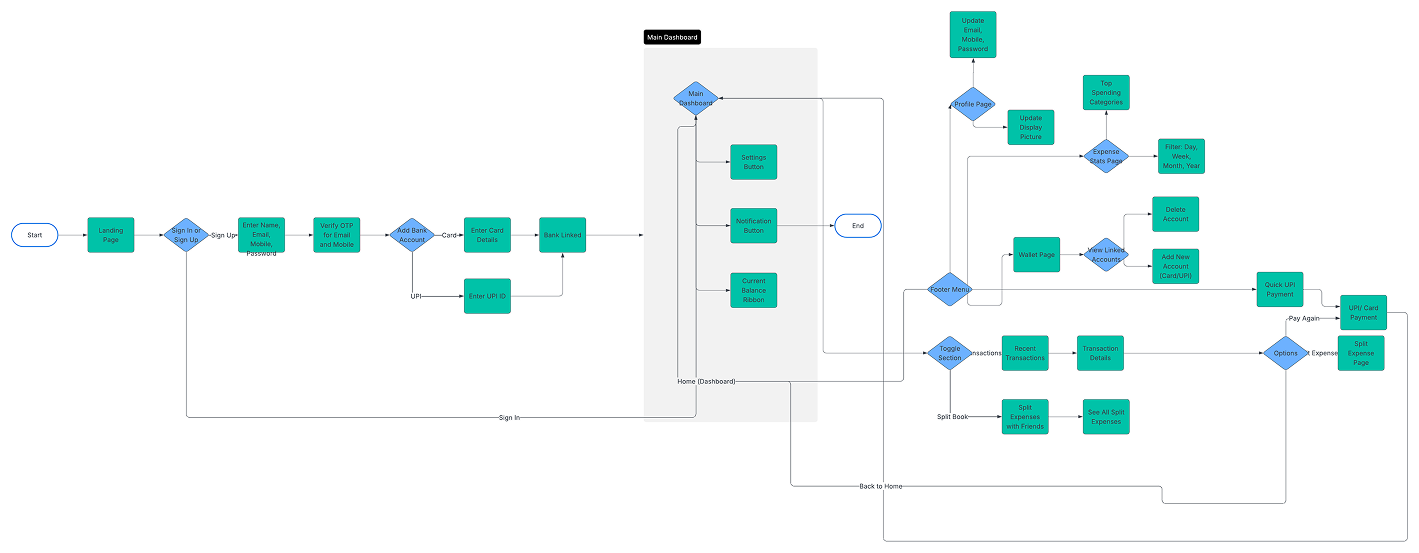

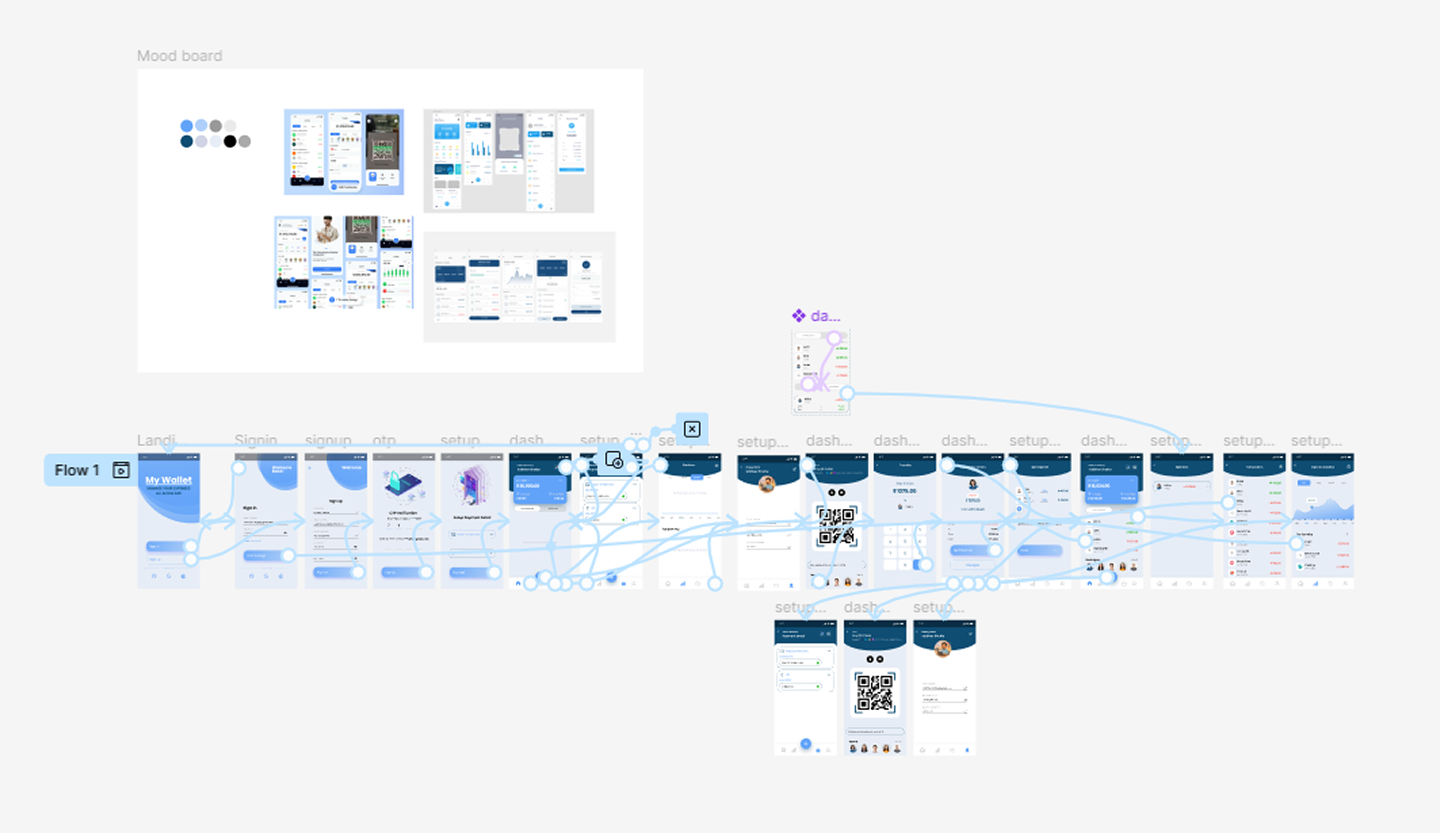

The development of this fintech wallet application was a highly iterative and user-driven journey. From the outset, the goal was to solve a real user pain point — managing personal and shared expenses seamlessly while keeping the interface clean and intuitive. Through competitor analysis, we identified gaps in existing apps around split expenses, transparency of transactions, and unified dashboards.

During testing, users responded positively to the simplicity of the dashboard, the quick payment feature, and the way split transactions were handled. These validations were crucial in shaping the final direction of the product. On the flip side, feedback around expectations like cashback, group-wise tracking, and minor UI confusions helped us prioritize future enhancements.

As a product owner, it was important to constantly balance between delivering core value quickly and planning scalable improvements for upcoming iterations. By staying close to the user needs, validating assumptions through feedback, and focusing on clear use-case flows, we were able to ship a product that feels both practical and delightful.

The experience reinforced the value of listening actively, validating continuously, and designing with empathy — the foundation of any successful product.